Weekly Newsletter – 29th October 2021

This week the political theatre of the UK’s budget has dominated the headlines. While the event is one of the highlights of the Westminster calendar, the modern practice of leaking everything in it to friendly media outlets has made the event itself something of an anti-climax. The headline announcements of a tax and spending program Jeremy Corbyn could’ve been proud of grabbed a lot of attention, however, there was still room for some old favourites like a commitment to a balanced budget and the now traditional delay in the increase in fuel duty.

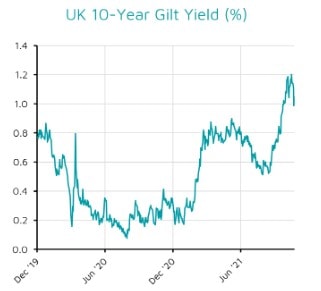

While markets had largely priced in everything they were already aware of, the immediate reduction of borrowing requirements took bond markets by surprise. Also notable in the market reaction was a decrease in expectations for the longer term, with short term worries about inflation giving way to longer term worries about recession. These expectations are somewhat reliant on the government actually doing the things it promised in the budget; track record aside, there will be plenty of chances for these plans to be changed even before they get the chance to be reneged on.

UK government bonds had their biggest rally since March 2020 after the Debt Management Office announced it will reduce its planned debt sales this year by £57.8bn as the UK economy continues to recover sharply. The buoyant forecast from the Office of Budget Responsibility also added optimism to the strength of the UK as it announced the economy is expected to regain its pre-Covid level by the end of the year. The growth forecast for 2021 has now been increased from 4% to 6.5%. Investors were expecting a much lower forecast and the 10-Year UK Gilt yields reduced from 1.14% to 0.98% as a result.

Following this Chancellor Rishi Sunak proposed a budget that is in line with “a new economy post-Covid” at the annual budget and spending review. Although economic recovery has been prompt for the UK, the budget aims to drive more capital into public services recovering from the Covid-19 crisis and offer tax cuts for business rates and tax duties.

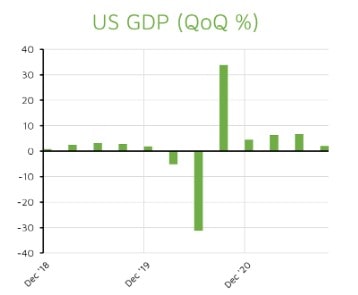

US: GDP SLOWDOWN

US economic growth slowed significantly in the third quarter of 2021 due to a combination of supply-chain disruptions, a resurgence of coronavirus and reduced spending on consumer goods. US GDP grew 2% in the three months to September, marking the weakest quarterly growth since the coronavirus decline. The new GDP growth represents a slowdown from 6.7% in the second quarter with consumption being a main contributor. Personal consumption rose just 1.6% which is a significant drop from the 12% rise previously.

Despite this, the US Consumer Confidence Index increased in October following declines in the previous three months. It now stands at 113.8, up from 109.8 in September. The rise in consumer confidence fuelled fears of an interest rate rise as Federal Reserve Chair Jerome Powell indicated during his September speech that the US economy would be strong enough to allow the central bank to begin reducing its asset purchase programme in November.

GLOBAL: MARKETS RALLY DESPITE POOR ECONOMIC DATA

Wall Street stocks shrugged off disappointing US economic growth data as investors began to focus on a series of strong earnings reports. The growth was driven by corporate earnings results from Microsoft, Google’s parent company Alphabet and earlier optimism for reports due from Apple and Amazon. Microsoft and Alphabet reported gains of 42% and 62% respectively, as the surge in cloud computing continued into the third quarter of 2021. However, supply-chain problems strained the results for Amazon and Apple as they both missed their revenue targets. Despite this, the technology-focused Nasdaq Composite index rose 2.81% and the S&P 500 increased 1%.

Meanwhile, European equity markets were shaken by the European Central Bank’s decision to slow its bond-buying programme. The Euro Stoxx 600 index fell 0.58% following the announcment that the pandemic emergency purchasing programme will continue at a “moderately lower pace” than in the second and third quarters of this year.

If you enjoy reading this weekly update, please feel free to share it with your friends and / or family who may also find the contents of interest, and do not hesitate to contact us if you need any help, information or advice yourself about any of the areas covered this week.

Yours sincerely, Phil Simmonds